Democratic legislators today unveiled a proposal to add $1.5 billion to the BEP — the state’s funding formula for public schools. Chalkbeat has more:

Democratic lawmakers called Wednesday for $1.5 billion more for public schools and an overhaul of an education funding formula that they called “fundamentally broken.”

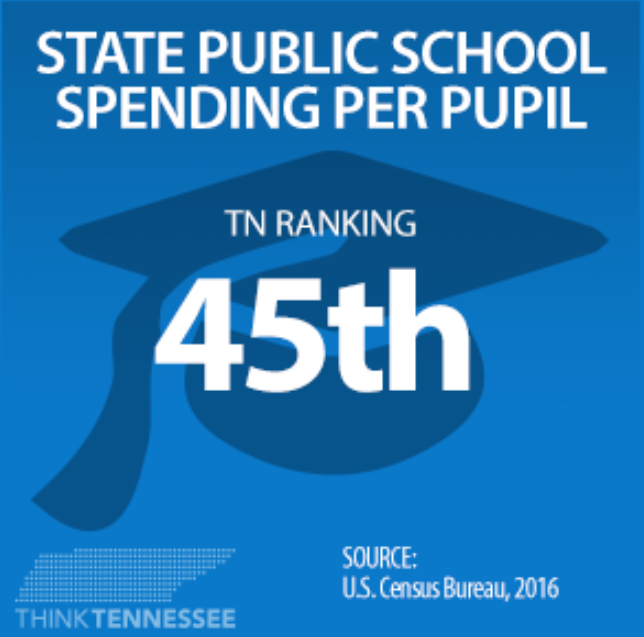

Tennessee’s investment of $9,225 per student trails most states in the South and its level of school funding remains the elephant in the room for state government. A trial is expected this year in a 5-year-old lawsuit filed by school districts in Memphis and Nashville over the adequacy of state funding for students and schools. If successful, the case could mean sweeping changes for how much Tennessee spends on K-12 education.

For instance, classroom size requirements have forced districts to hire more than 9,000 teachers beyond what the BEP provides to pay for their salaries, according to a recent analysis presented to the BEP Review Committee.

Back in 2014, I wrote that the BEP formula was broken:

As I mentioned, the BEP includes an instructional component which provides districts funding for teacher salaries. The current instructional component sets a salary number of $40,447. The state then funds this component at 70%, leaving districts to pay 30% of the salary cost for that teacher.

There are a few problems with this. First, nearly every district in the state hires more teachers than the BEP formula generates. This is because students don’t arrive in neatly packaged groups of 20 or 25, and because districts choose to enhance their curriculum with AP courses, foreign language, physical education, and other programs. This add-ons are not fully contemplated by the BEP.

Next, the state sets the instructional component for teacher salary at $40,447. The average salary actually paid to Tennessee teachers is $50,355. That’s slightly below the Southeastern average and lower than six of the eight states bordering Tennessee. In short, an average salary any lower would not even approach competitiveness with our neighbors.

While those are 2014 numbers, the disparity between the BEP salary allocation and the actual cost of a teacher still exists. It means the state is picking up far less than the 70% of instructional costs contemplated by the BEP. In fact, one possible path forward would be to fund teacher salaries through the BEP at a rate equal to the average actual cost of a teacher. That’s actually what Shelby County proposed back in 2014. The cost? $500 million.

Next, making up the 9000 teacher deficit — the gap between what the BEP generates and the number of teachers ACTUALLY hired by districts. That cost? Around $500 million.

Tennessee has both less teachers than we need AND we pay them less than we should. Addressing those two issues costs about $1 billion.

The other $500 million? Funding for counselors, nurses, and other critical support staff for schools.

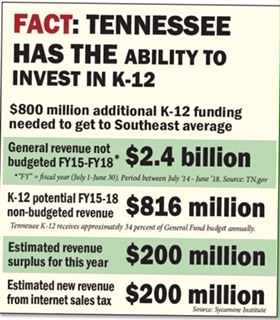

Tennessee has the money — with years of record surpluses boosting the state’s coffers. Will the General Assembly elect to spend that money on an investment in our schools?

For more on education politics and policy in Tennessee, follow @TNEdReport

Your support — $5 or more today — makes publishing education news possible.