Can policymakers summon the will to make school meals free for all kids?

State Rep. John Ray Clemmons is frustrated. Angry, even.

He’s been trying for years to get his fellow lawmakers to fund a plan to make school meals free for all kids.

This year, a Republican lawmaker joined the fight – sponsoring a bill similar to one Clemmons has carried in the past. Still, the bill was met with stiff resistance by legislators.

The national trend is toward schools providing meals for free for all kids.

The Tennessee trend is in favor of hundreds of millions of public dollars to fund a stadium for a private business owner and $1.6 billion for a corporate tax break.

Rather than fund school lunches, lawmakers and Gov. Lee seek annually to find new schemes that would use taxpayer money to fund unaccountable private schools.

For the past decade, the state has run budget surpluses in the range of $1-3 billion.

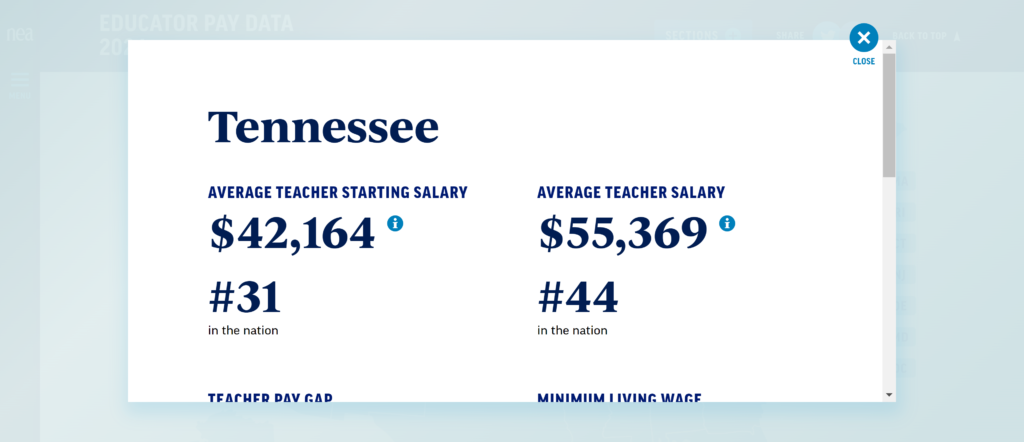

Rather than fund school lunches or boost teacher pay or invest in Medicaid expansion, or end the grocery tax, lawmakers have found a dizzying array of ways to reduce revenue by lowering or eliminating taxes paid by the wealthy or corporations.

The problem is so acute that Tennessee is in real danger of running a significant budget deficit in the 2025 fiscal year.

If Bill Lee ran his HVAC business this way, they’d be filing for bankruptcy.