The 2017 session of the Tennessee General Assembly is underway and as always, education is a hot issue on the Hill. The bill filing deadline was yesterday and some familiar issues are back again. Namely, vouchers.

While the voucher fight may be the biggest education showdown this session, issues ranging from the scope of the state’s Achievement School District to a “Teacher Bill of Rights” and of course, funding, will also be debated.

Here’s a rundown of the big issues for this session:

Vouchers

Senator Brian Kelsey of Shelby County is pushing a voucher plan that is essentially a pilot program that would apply to Shelby County only. Voucher advocates have failed to gain passage of a plan with statewide application over the past four legislative sessions. The idea behind this plan seems to be to limit it to Shelby County in order to mitigate opposition from lawmakers who fear a voucher scheme may negatively impact school systems in their own districts.

In addition to Kelsey’s limited plan, Rep. Bill Dunn of Knoxville is back with the “traditional” voucher bill he’s run year after year. This plan has essentially the same requirements as Kelsey’s plan, but would be available to students across the state. It’s not clear which of these two plans has the best chance of passage. I suspect both will be set in motion, and as time wears on, one will emerge as most likely to be adopted. Voucher advocates are likely emboldened by the election of Donald Trump and the subsequent appointment of Betsy DeVos as Secretary of Education.

Of course, Tennessee already has one type of voucher. The legislature adopted an Individual Education Account voucher program designed for students with special needs back in 2015. That proposal goes into effect this year. Chalkbeat reported that only 130 families applied. That’s pretty low, considering some 20,000 students meet the eligibility requirements.

Achievement School District

Two years ago, I wrote about how the ASD’s mission creep was hampering any potential effectiveness it might have. Now, it seems that even the ASD’s leadership agrees that pulling back and refocusing is necessary. Grace Tatter of Chalkbeat reports:

Lawmakers are considering a bill that would stop the Achievement School District from starting new charter schools, rather than just overhauling existing schools that are struggling.

Rep. David Hawk of Greeneville filed the bill last week at the request of the State Department of Education. In addition to curbing new starts, the legislation proposes changing the rules so that the ASD no longer can take over struggling schools unilaterally. Instead, the state would give local districts time and resources to turn around their lowest-performing schools.

Tatter notes that the Tennessee Department of Education and the ASD’s leadership support the bill. This is likely welcome news for those who have raised concerns over the ASD’s performance and approach.

Teacher Bill of Rights

Senator Mark Green of Clarksville has introduced what he’s calling a “Teacher Bill of Rights.” The bill outlines what Green sees as some basic protections for teachers. If adopted, his proposal would have the effect of changing the way the state evaluates teachers. Among the rights enumerated in SB 14 is the right to “be evaluated by a professional with the same subject matter expertise,” and the right to “be evaluated based only on students a teacher has taught.”

While both of these may seem like common sense, they are not current practice in Tennessee’s public schools. Many teachers are evaluated by building leaders and others who lack subject matter expertise. Further, teachers who do not generate their own student growth scores (those who don’t teach in tested subjects) are evaluated in part on school-wide scores or other metrics of student performance — meaning they receive an evaluation score based in part on students they’ve never taught.

Green’s Teacher Bill of Rights will almost certainly face opposition from the Department of Education.

Funding

Governor Bill Haslam is proposing spending over $200 million in new money on schools. Around $60 million of that is for BEP growth. $100 million will provide districts with funds for teacher compensation. And, there’s $22 million for English Language Learners as well as $15 million for Career and Technical Education.

These are all good things and important investments for our schools. In fact, the BEP Review Committee — the state body tasked with reviewing school funding and evaluating the formula’s effectiveness, identified teacher pay and funds for English Language Learners as top priorities.

Here’s the full list of priorities identified by the BEP Review Committee for this year:

1. Sustained commitment to teacher compensation

2. English Language Learner funding (to bring ratios closer to the level called for in the BEP Enhancement Act of 2016)

3. Funding the number of guidance counselors at a level closer to national best practices

4. Funding Response to Instruction and Intervention positions

5. Sustained technology funding

Haslam’s budget proposal makes an effort to address 1 and 2. However, there’s no additional money to improve the guidance counselor ratio, no funds for the unfunded mandate of RTI and no additional money for technology.

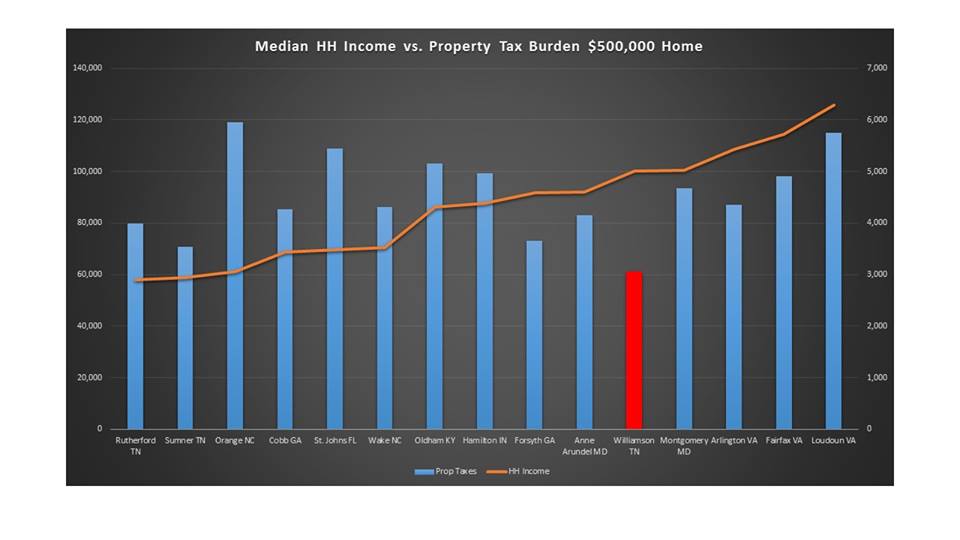

Oh, and then there’s the persistent under-funding of schools as a result of a BEP formula that no longer works. In fact, the Comptroller’s Office says we are under-funding schools by at least $400 million. Haslam’s budget does not address the funding ratios that create this inadequacy.

Then, of course, improving the ratios does nothing on its own to achieve a long-standing BEP Review Committee goal: Providing districts with teacher compensation that more closely matches the actual cost of hiring a teacher. The projected cost of this, according to the 2014 BEP Review Committee Report, is around $500 million.

The good news is we have the money available to begin addressing the ratio deficit. The General Assembly could redirect some of our state’s surplus dollars toward improving the BEP ratios and start eating into that $400 million deficit. Doing so would return money to the taxpayers by way of investment in their local schools. It would also help County Commissions avoid raising property taxes.

Stay tuned as the bills start moving next week and beyond. It’s expected this session could last into May, and education will be a flash point throughout over these next few months.

For more on education politics and policy in Tennessee, follow @TNEdReport