Members of the Williamson County Commission’s Education Committee voted unanimously Monday night in favor of a resolution supporting changes in the state’s BEP formula that would direct additional state resources to the wealthiest county in the state. Williamson County is also the 7th wealthiest county in the United States.

The Williamson Herald reports:

Members of the Williamson County Commission’s education committee voted unanimously Monday night to approve a resolution of support for state legislation that would modify the Basic Education Program (BEP) to provide Williamson County and others a more reasonable allotment of state funding for education.

I suppose “reasonable allotment” is in the eye of the beholder.

The state’s funding formula for schools, the BEP, is designed to provide all districts a base level of funding to support public education. The formula came about in response to a successful lawsuit by small, rural districts who sued suggesting the way the state was funding schools was unequal. In 1992, the General Assembly enacted the Education Improvement Act which included the Basic Education Plan (BEP) as a new school funding formula. One of the primary goals of this formula was (and still is) equity.

What the legislation sponsored by Jack Johnson would do is direct additional state resources to the five school districts in the state with the greatest ability to pay.

While the BEP certainly has shortcomings, I would suggest finding ways to direct more state funds to a county quite capable (but unwilling) to dedicate local resources to schools is not a very responsible use of state taxpayer dollars. To be clear, improving the BEP by making formula adjustments (adding a component for RTI, for example), would necessarily mean additional funds going to Williamson County.

Here are some fun facts about the county now begging the state for more cash:

Williamson County has the lowest property tax rate of any county in Middle Tennessee.

Williamson County has the lowest property tax rate of any county in Tennessee with a population over 100,000.

Williamson County is the wealthiest county in the state of Tennessee and 7th wealthiest in the United States.

Williamson County Commissioners have been reluctant to raise property taxes in order to continue to provide resources to schools.

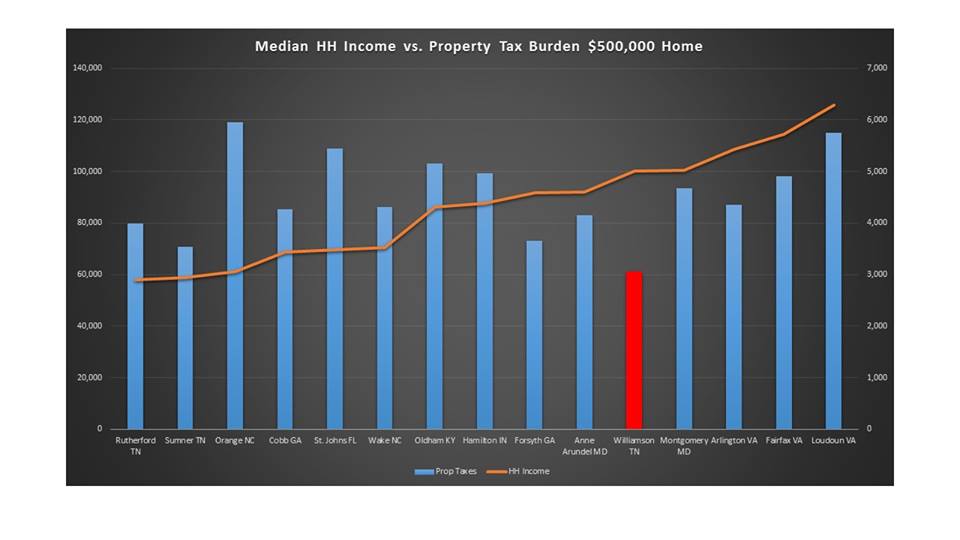

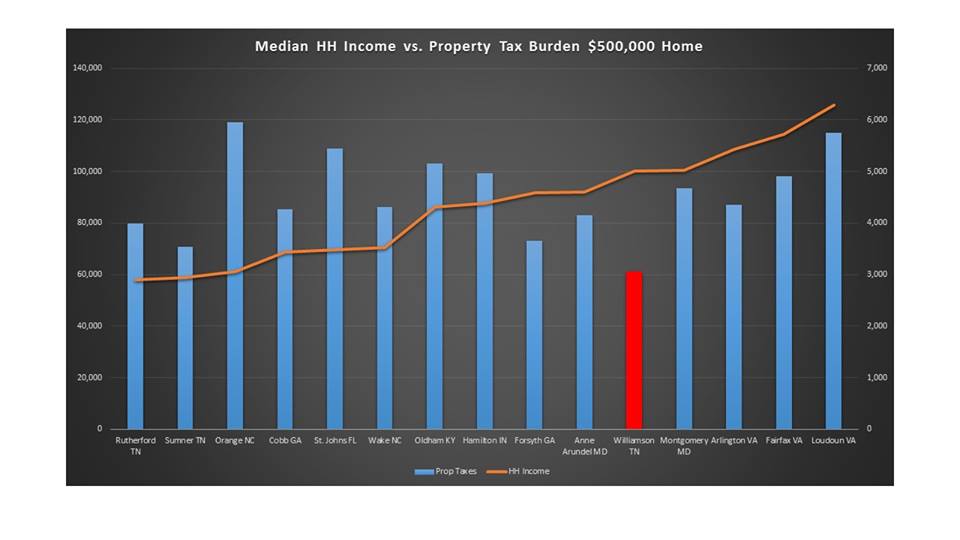

An analysis of household income compared to property tax rates in similar affluent communities reveals that Williamson County’s tax burden is incredibly low. The chart below comes from public policy professor Ken Chilton, who teaches at Tennessee State:

That red bar on the chart is Williamson County, with a property tax burden on a $500,000 home of just over $3000. That’s just over 3% of the average household income, far lower than similar communities in Tennessee and across the country. Plus, as Chilton notes, Tennesseans pay no personal income tax.

Despite these facts, Williamson County Commissioners are headed to the state with their hands out, begging for more help.

Tennessee is a state making long overdue improvements in public education. As more state dollars become available, those dollars should absolutely be invested in continuing to improve our public schools. By closing the teacher pay gap, for example.

Giving money to those districts that have the ability to generate funds on their own but won’t is not a pressing need in our state. In fact, doing so would only serve to exacerbate the inequity the BEP was intended to address. Of course, these Williamson County Commissioners aren’t concerned about inequity. They are clearly concerned about ensuring one of America’s wealthiest communities continues to pay bargain basement prices for its public schools.

Policymakers should reject this rich get richer scheme and focus on education needs that will benefit every district and lift up those least able to generate funds for schools.

For more on education politics and policy in Tennessee, follow @TNEdReport