Tucked inside this Chalkbeat story on Hamilton County dropping its lawsuit over state funding of public schools is a note about just how inadequate the formula (the BEP) is.

In Tennessee, classroom size requirements have forced districts to hire more than 9,000 teachers beyond what the BEP provides to pay for their salaries, according to a statewide analysis presented by the Department of Education in December to the BEP Review Committee.

When looking at an average actual salary for Tennessee teachers of around $52,000, this means that local districts are responsible for $468 million in teacher salary expenses before benefits are included. That’s an unfunded mandate that easily exceeds half a billion dollars.

No one is suggesting we hire less teachers. In fact, many districts report needing additional teachers and other staff — such as nurses and counselors — to adequately serve their students.

However, this number does show that our state systematically underfunds public schools in a way not addressed by the current funding formula. It’s likely that when you combine the unfunded salary and benefits of teachers and the needs for programs like RTI2 with the proper staffing levels for nurses and counselors, you’d see a number exceeding $1 billion.

Let’s be clear: The state’s own Department of Education has provided information to the committee responsible for reviewing the state funding formula that indicates we’re at least $500 million behind where we should be in terms of current funding.

It’s also worth noting that these numbers don’t include any significant boost in pay for existing teachers.

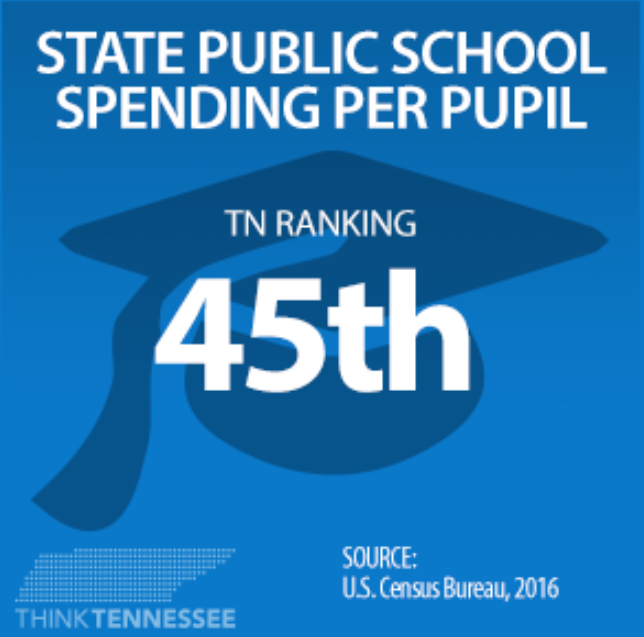

In short: Tennessee is not properly funding schools.

For more on education politics and policy in Tennessee, follow @TNEdReport

Your support — $5 or more today — makes reporting education news possible.